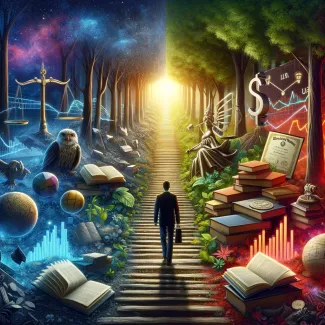

From the shadows to the light

DIS and DAT - From the shadows to the light - July 2018

Our periodic communication that reminds you to ask, “Should I react to those headlines?”

“Education is the movement from darkness to light.” Allan Bloom

Dear Friends:

Recently I was approached by a young rising star to “shadow” me at work. While greatly humbled and honored, I believe there are far better people for this up-and-comer to learn from. There is simply much more to be learned than what can be observed in a single day, so I prepared for him a reading list to give him a more comprehensive perspective into what makes a great investment manager. You can also benefit from this list by gaining a more thorough understanding of what we consider valuable and worthy of study in managing money.

Ethics

“Honesty is the best policy.” Benjamin Franklin

Approaching business without a solid foundation of ethics can ruin your life and the lives of those around you. It would be better not to go into business if you aren’t committed to maintaining and promoting an ethical business. Contrary to what we learn as youngsters, if you find yourself on the wrong path in this category, immediately stop and quit. Be a quitter.

- Charlie Munger’s 7 Ways to Guarantee a Life of Misery (read immediately) https://medium.com/personal-growth/charlie-munger-how-to-guarantee-a-life-of-misery-c8e6d8abc2cc

- Education of a Value Investor by Guy Spier

- Warren Buffett’s Ground Rules by Jeremy Miller

- Benjamin Franklin’s autobiography

Formal Education/College

“Invest in yourself. Your career is the engine of your wealth.” Paul Clitheroe

Even though these may not be your favorite subjects, study them.. College is great for efficiency, broadness, credibility, and relationships. These subjects are universal, so there’s no such thing as “too late” to learn them. Having an understanding of even the basic principles will make you a smarter, savvier investor.

- Accounting

- Business Law

- Tax Corporate and Personal

Fundamental Investing

“Investing is most intelligent when it is most business-like.” Warren Buffett

From our experience, the best approach to investing is one that analyzes the business underlying the stock. Listed below are two slightly different approaches, both focus on imparting the fundamentals of business analysis.

- The Intelligent Investor by Benjamin Graham

- Common Stocks and Uncommon Profits by Philip Fisher

Economics

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready to do well in the markets.” Peter Lynch

We believe that cost, political, and economic conditions cycle. Yet we have found no useful way of predicting these economic changes. We think the best outlook is to be rationally optimistic and stick to that view. The book below should help you to do that.

The Rational Optimist: How Prosperity Evolves by Matt Ridley

Management/Leadership

“Good business leaders create a vision, articulate the vision, passionately own the vision, and relentlessly drive it to completion.” Jack Welsh

- Good Profit by Charles Koch

- The Outsiders by William Thorndike

- The Essential Wooden by John Wooden

Allocation

“I find it preposterous that a single number reflecting past price fluctuations could be thought to completely describe the risk in a security. Beta views risk solely from the perspective of market prices, failing to take into consideration specific business fundamentals or economic developments. The price is also ignored, as if IBM selling at $50 per share would not be a lower risk than the same IBM at $100 per share.” Seth Klarman

- Concentrated Investing by Benello, Van Biema and Carlisle

- Rule #1 by Phil Town

Attitude

Independent thought is a necessity in investing. It is very difficult to learn and become comfortable with the thought of being different than the crowd. Your investment selections will need to be at odds with the herd in order to be successful. There is no way around that. These two books may give you comfort in the darkest days when it seems everyone is against you, including the price.[JA1]

- Munger Damn Right by Janet Lowe

- Am I being too subtle by Sam Zell

Daily/Weekly

When you are developing your knowledge, business news channels such as CNBC and Fox Business News can be a great place to learn terminology. The problem is that after you learn the terminology, there is too much noise and far too many distractions in that form of news. Watching it too much can weaken the discipline it takes to be successful. So once you’ve grown comfortable with the basics, move on to these more mature sources and practices for news.

- Business News: Wall Street Journal, Seekingalpha.com; (while young[JA2] ) CNBC, Fox Business News

- Local Business News: Pick five cities around the U.S. and scan their business headlines online.

- Industry Books and trade magazines from industries you enjoy to develop your circle of competence.

- Corporate reports: Annual reports and quarterly transcripts (seekingalpha.com) from companies of interest.

I have come up with the categories to help the young professional who is shadowing me, but these could be of help to anyone looking to improve their knowledge of wealth and investing. A lot of the readings will overlap, and you will begin to see reoccurring themes. The goal is to develop yourself as a wise and wealthy individual capitalist, regardless of your occupation. Hopefully, the above will allow you to begin compounding the knowledge, wealth, and relationships necessary to better understand and take control of your wealth.

Of course, the higher level of success remains non-financial. Warren Buffett, with all the trappings of success, has said that he believes being loved by those you love is the highest level of success.

Best of luck!

See you next time.

James Pope

Please remember to contact Diversified Investment Strategies, LLC dba Advisor.Investments, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that Diversified Investment Strategies, LLC DBA Advisor.Investments to effect any specific transactions for your account. A copy of our current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Diversified Investment Strategies, LLC dba Advisor.Investments), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Diversified Investment Strategies, LLC dba Advisor.Investments. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Diversified Investment Strategies, LLC DBA Advisor.Investments is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. If you are a Diversified Investment Strategies, LLC dba Advisor. Investments client, please remember to contact Diversified Investment Strategies, LLC dba Advisor.Investments, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of the Diversified Investment Strategies, LLC dba Advisor.Investments current written disclosure statement discussing our advisory services and fees is available upon request.

Advisory Services through Advisor.Investments • A doing business as name of Diversified Investment Strategies, LLC, an SEC Registered Investment Advisor • Insurance Services through Advisor.Investments

Main Office and Mailing Address: 11939 Bricksome Avenue, Baton Rouge, LA 70816

Voice: (225) 292-0687 ~ Fax: (225)292-0006 ~ Toll Free: (866) 748-0687